NYS Deferred Compensation PlanNYS Deferred Compensation Plan Management

Pronova

NYS Deferred Compensation Plan Management

Self Directed Investment Account

OFFERED THROUGH SCHWAB PERSONAL CHOICE RETIREMENT ACCOUNT ® (PCRA)

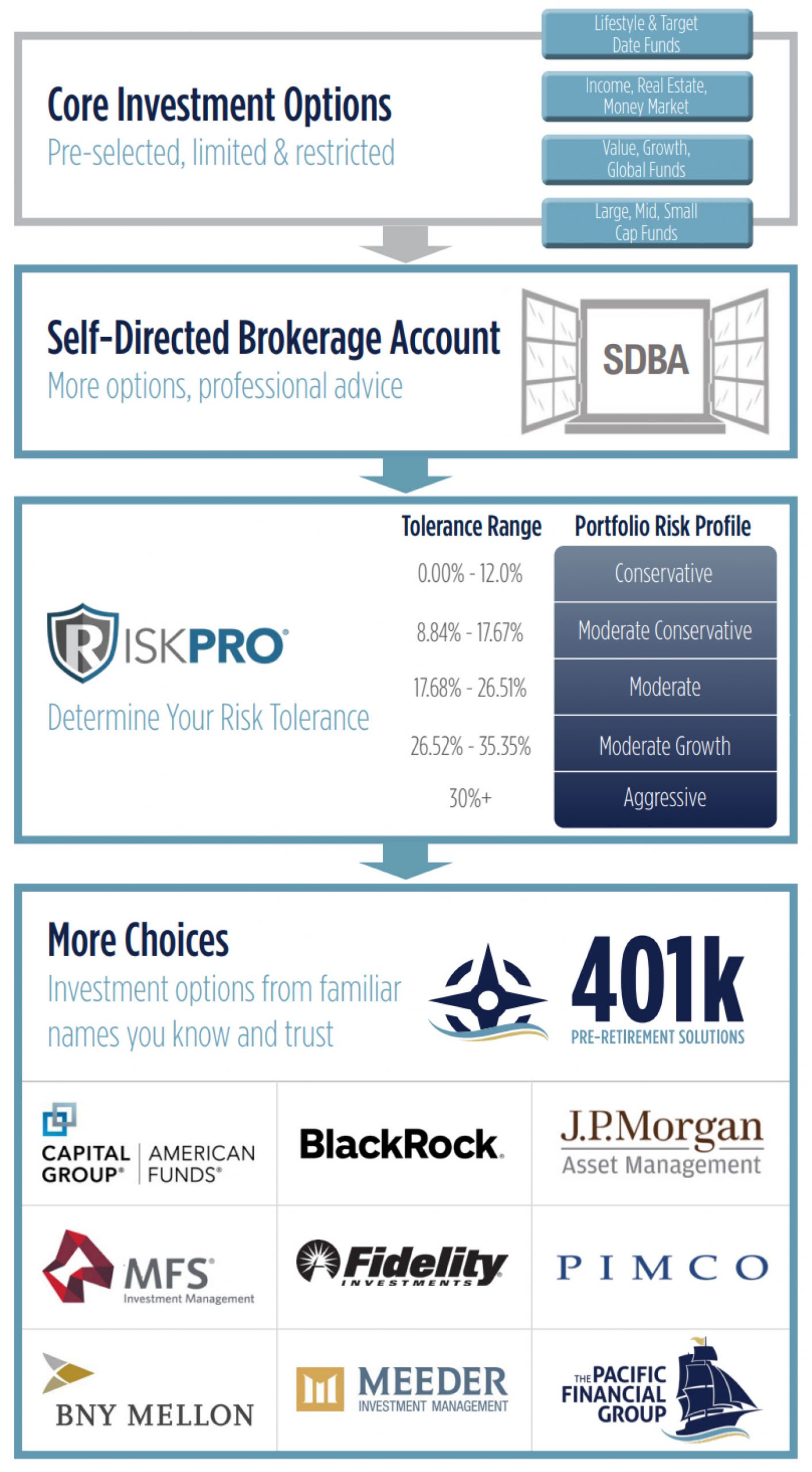

The New York State Deferred Compensation Plan (Plan) allows participants to invest a portion of their Plan account assets in mutual funds, other than those offered as core investment options under the Plan, and Exchange Traded Funds (ETFs). This service, known as the Self Directed Investment Account, is provided through the Charles Schwab and Co., Inc. (Schwab) Personal Choice Retirement Account® (PCRA), which is a self-directed investment account The Self Directed Investment Account gives you the freedom and responsibility of selecting and managing investments from a much larger universe of mutual funds than is offered under the Plan.

Professional Help

As a participant in the New York State Deferred Compensation Plan, you have the option to allocate up to 50% of your Core Plan Account into the Self Directed Investment Account (SDIC). Once the SDIC is funded, you now have access to work with us directly and receive professional investment management of those funds. No more call centers, no more generic mediocre mutual funds, you now will receive the support you deserve! Here’s what the process looks like….

Pronova

NYS Deferred Compensation Plan Management

HOW IS THE PCRA DIFFERENT FROM THE PLAN’S CORE INVESTMENT OPTIONS?

The difference between the mutual funds offered as core investment options under the Plan and mutual funds offered through the PCRA is that the New York State Deferred Compensation Board (Board) reviews the core investment options (detailed in the Plan brochure entitled, “A Guide to the Plan’s Investment Options”). Periodic changes are made to the Plan’s core investment options to ensure that participants are provided with a diverse selection of suitable long-term investment vehicles. While the Board will be monitoring the overall Self Directed Investment Account service being offered through Schwab, the Board will not be monitoring or reviewing the over mutual funds or ETFs offered through the PCRA.

Why establishing your PCRA, you will be managing your own investments. You will have the freedom and responsibility to plan your investment strategy, research the options, monitor fund performance, evaluate the progress of your investments, make adjustments, and initiate changes as needed. You are solely responsible for determining whether a particular investment option is a proper investment for you and your long-term retirement savings goals.

HOW IS THE PCRA DIFFERENT FROM A TYPICAL BROKERAGE ACCOUNT?

The PCRA differs from a typical consumer brokerage account because it is funded only through transfers from your Core Plan Account. You cannot make direct deposits to your PCRA or take Plan withdrawals or receive Plan distributions from your PCRA. If you have any other accounts with Schwab (or another brokerage account provider), such as an Individual Retirement Account (IRA), you cannot transfer assets between your other accounts and your PCRA. Funds invested through your PCRA continue to be regulated by Section 457 of the Internal Revenue Code and the Plan, and all restrictions imposed on your Core Plan Account also apply to any funds transferred to your PCRA.

Also, unlike typical consumer brokerage accounts, the Plan has limited the investment options available through your PCRA to mutual funds or ETFs only. Investments in individual stocks and bonds and the trading of options are not allowed.